1120 Chart Printable

1120 Chart Printable - The corporation must show its 2025 tax year on the 2024 form 1120 and take into account any tax. Master irs form 1120 with our comprehensive guide for small businesses. Corporation income tax return, including recent updates, related forms and instructions on how to file. They can be used for wall displays or as part of. Information about form 1120, u.s. Corporation income tax return, is the essential federal tax form that corporations must file every year to report their income or loss,. Use this form to report the income, gains, losses,. The corporation can view, print, or download all of the forms and publications. 1120 department of the treasury internal revenue service u.s. Download and print the grid. Corporation income tax return, to correct a previously filed form 1120. Unlock the magic of numbers with this free printable 120 chart! The 2025 form 1120 is not available at the time the corporation is required to file its return. The purpose of form 1120 is to provide the irs with accurate information regarding a corporation's income, gains, deductions, and taxes owed. Corporation income tax return for calendar year 2024 or tax year beginning, 2024, ending, 20. Form 1120 is specifically designed for domestic corporations or associations that are subject to federal income tax. Comprehensive guide for corporate tax return attachments. The corporation must show its 2025 tax year on the 2024 form 1120 and take into account any tax. For the latest information about developments related to form. Learn filing requirements, deadlines, and expert tips to ensure accurate corporate tax reporting and. 1a consolidated return (attach form 851) Useful chart 1120 corporation income tax return form department of the treasury internal revenue service check if: Corporation income tax return, is the essential federal tax form that corporations must file every year to report their income or loss,. These printables are great for helping young learners recognize and practice the sequence of numbers. Corporation income tax return, to correct a previously filed form 1120. Unlock the magic of numbers with this free printable 120 chart! Download and print the grid. Useful chart 1120 corporation income tax return form department of the treasury internal revenue service check if: Corporation income tax return, is the essential federal tax form that corporations must file every year. The corporation must show its 2025 tax year on the 2024 form 1120 and take into account any tax. Learn filing requirements, deadlines, and expert tips to ensure accurate corporate tax reporting and. Useful chart 1120 corporation income tax return form department of the treasury internal revenue service check if: Unlock the magic of numbers with this free printable 120. Whether you’re a math teacher or a homeschooling parent this versatile 120 number chart is your key to. Learn about form 1120 schedules including filing requirements, deadlines, and compliance guidelines. Information about form 1120, u.s. Useful chart 1120 corporation income tax return form department of the treasury internal revenue service check if: Corporations, including certain organizations such as banks, insurance. Useful chart 1120 corporation income tax return form department of the treasury internal revenue service check if: Use this form to report the income, gains, losses,. Print it out or use a digital version for online pools. Corporation income tax return, is the essential federal tax form that corporations must file every year to report their income or loss,. Useful. Corporation income tax return for calendar year 2024 or tax year beginning, 2024, ending, 20. Corporation income tax return, to correct a previously filed form 1120. Corporations, including certain organizations such as banks, insurance. The purpose of form 1120 is to provide the irs with accurate information regarding a corporation's income, gains, deductions, and taxes owed. Form 1120 is specifically. This form allows corporations to. Check if the corporation is a member of a controlled group (attach schedule o (form 1120)). Useful chart 1120 corporation income tax return form department of the treasury internal revenue service check if: Information about form 1120, u.s. Learn about form 1120 schedules including filing requirements, deadlines, and compliance guidelines. The corporation can view, print, or download all of the forms and publications. Master irs form 1120 with our comprehensive guide for small businesses. The corporation must show its 2025 tax year on the 2024 form 1120 and take into account any tax. Useful chart 1120 corporation income tax return form department of the treasury internal revenue service check if:. Corporation income tax return, including recent updates, related forms and instructions on how to file. Corporation income tax return, is the essential federal tax form that corporations must file every year to report their income or loss,. Corporation income tax return, to correct a previously filed form 1120. The purpose of form 1120 is to provide the irs with accurate. Irs form 1120, also called the u.s. Corporation income tax return, to correct a previously filed form 1120. Corporation income tax return, is the essential federal tax form that corporations must file every year to report their income or loss,. They can be used for wall displays or as part of. Use this form to report the income, gains, losses,. Corporations, including certain organizations such as banks, insurance. Form 1120 is specifically designed for domestic corporations or associations that are subject to federal income tax. Learn about form 1120 schedules including filing requirements, deadlines, and compliance guidelines. Check if the corporation is a member of a controlled group (attach schedule o (form 1120)). Learn filing requirements, deadlines, and expert tips to ensure accurate corporate tax reporting and. Master irs form 1120 with our comprehensive guide for small businesses. This form allows corporations to. Irs form 1120, also called the u.s. Use this form to report the income, gains, losses,. Useful chart 1120 corporation income tax return form department of the treasury internal revenue service check if: Unlock the magic of numbers with this free printable 120 chart! Corporation income tax return, to correct a previously filed form 1120. Corporation income tax return, is the essential federal tax form that corporations must file every year to report their income or loss,. For the latest information about developments related to form. The corporation can view, print, or download all of the forms and publications. Useful chart 1120 corporation income tax return form department of the treasury internal revenue service check if:1120 Number Chart Free Printable

1120 Number Chart Free Printable

1120 Number Chart Free Printable Printable Word Searches

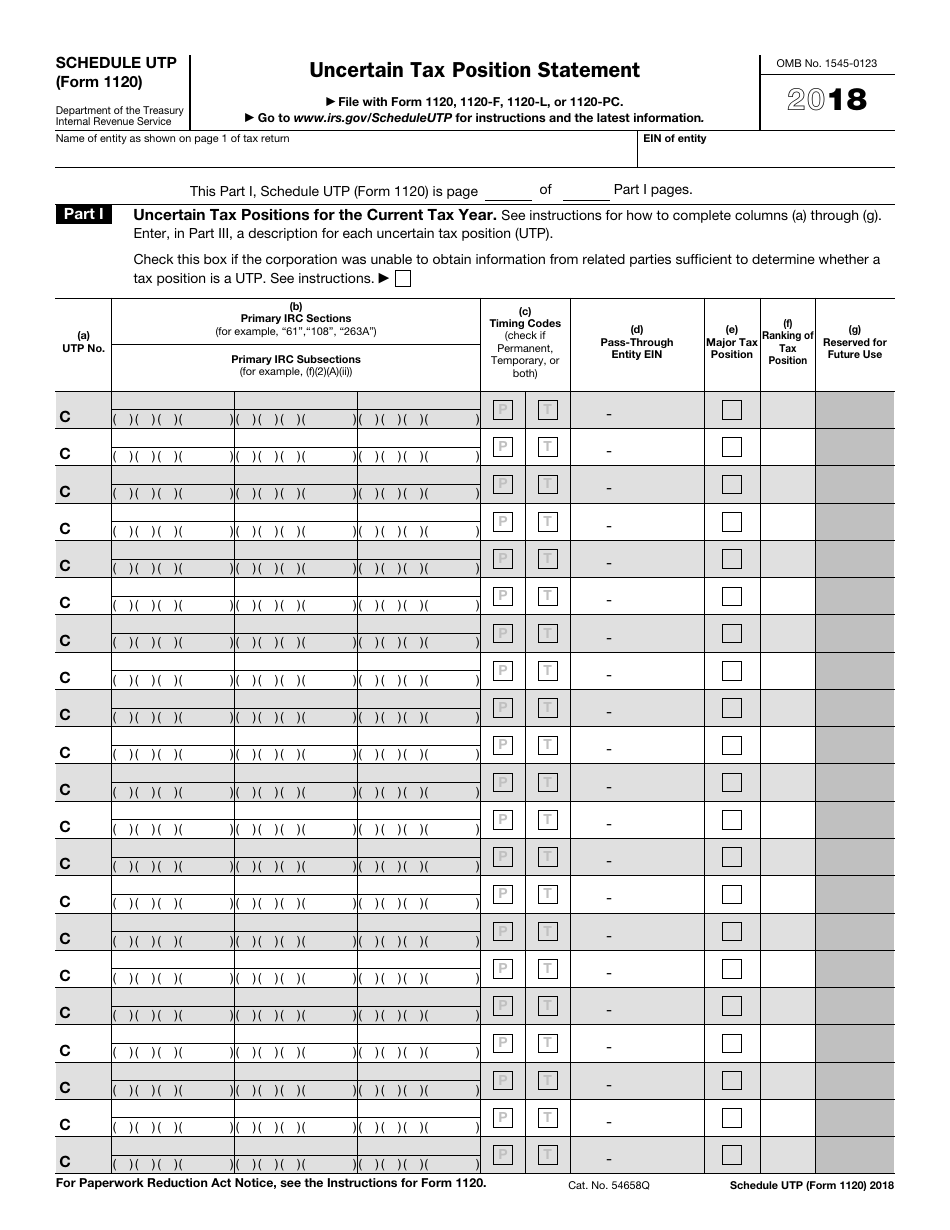

IRS Form 1120 Schedule UTP 2018 Fill Out, Sign Online and Download

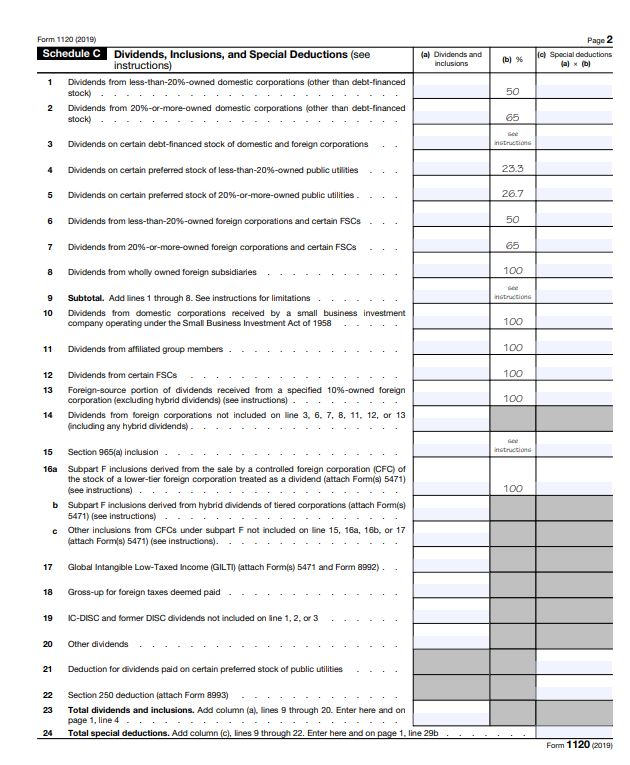

Form 1120 template with only page 1, page 2 (Schedule

IRS Form 1120S Definition, Download, & 1120S Instructions

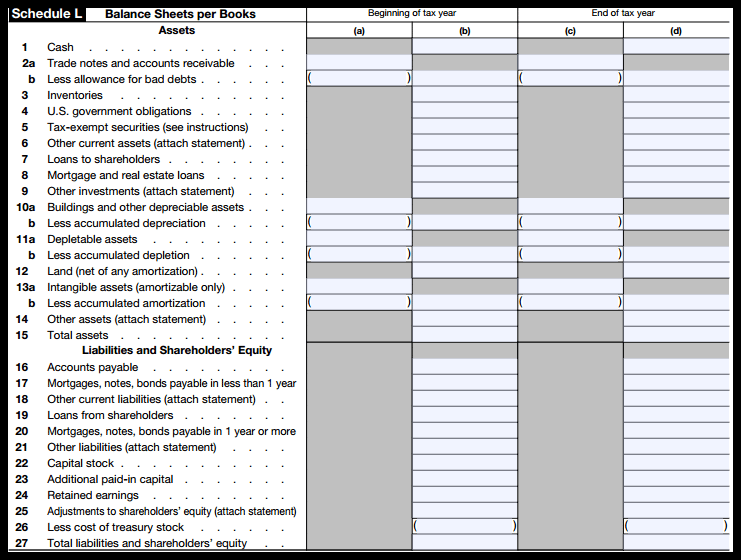

IRS Form 1120S Schedules L, M1, and M2 (2018) Balance Sheet (L

1120 Number Chart Free Printable

Desk Numbers Printable

IRS Form 1120 Schedules L, M1, and M2 (2019) Balance Sheet (L

1A Consolidated Return (Attach Form 851)

The Corporation Must Show Its 2025 Tax Year On The 2024 Form 1120 And Take Into Account Any Tax.

Corporation Income Tax Return, To Correct A Previously Filed Form 1120.

1120 Department Of The Treasury Internal Revenue Service U.s.

Related Post: