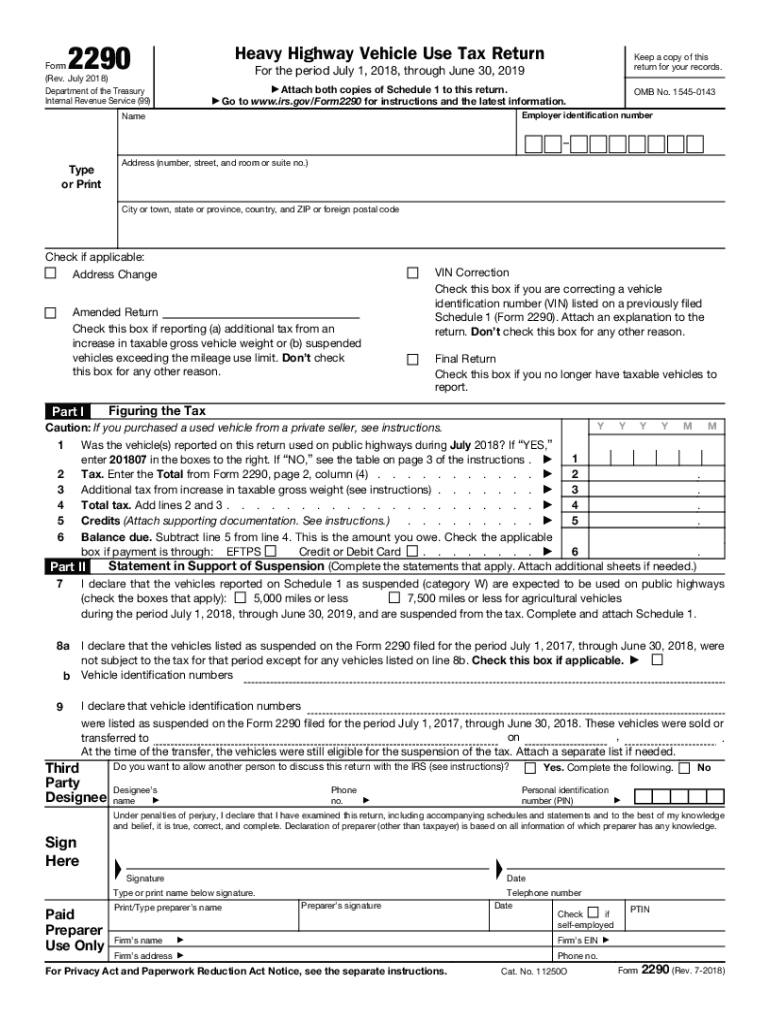

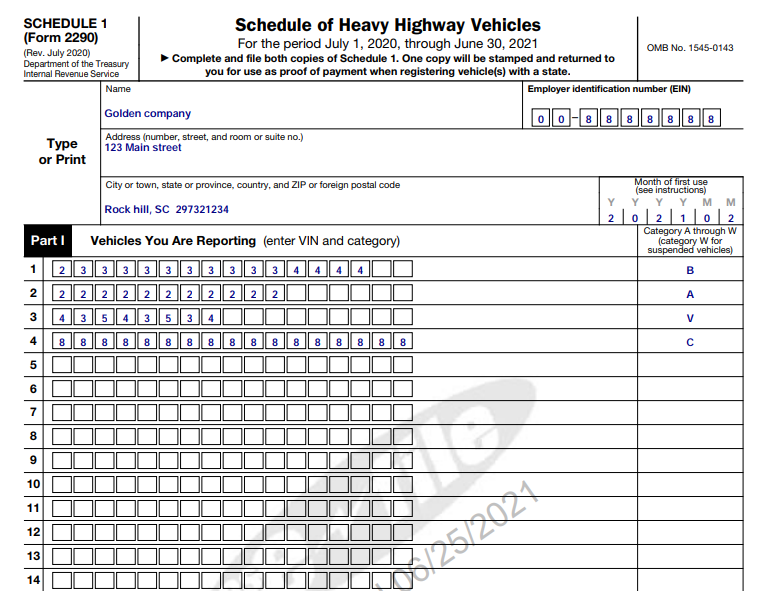

Form 2290 Printable

Form 2290 Printable - Download form 2290 for current and previous years. Once you’ve chosen a payment method and reviewed your form 2290 for accuracy, it’s time to submit your return. You must file this form 2290 (rev. Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. July 2019) department of the treasury internal revenue service (99) heavy highway vehicle use tax return for the period july 1, 2019, through june 30, 2020 attach. Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Understanding the submission process for form 2290. July 2019) for the tax period beginning on july 1, 2019, and ending on june 30, 2020. It covers the tax period from july 1, 2020, to june 30, 2021. Form 2290 is used to figure and. For truck owners and operators in the united states, printable form 2290 is essential to tax compliance. Form 2290 is used to figure and. The sample is available in pdf format; It covers the tax period from july 1, 2020, to june 30, 2021. Get schedule 1 in minutes. You'll need a pdf reader to open and print it. Understanding the submission process for form 2290. Like all tax forms, this form requires personal. You can visit the official irs website to download and print out the blank 2290 form for 2022. You must file this form 2290 (rev. The sample is available in pdf format; The current period begins july 1, 2024, and ends june 30,. This irs form 2290 is used for reporting heavy highway vehicle use tax. Download form 2290 for current and previous years. Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway motor vehicle (defined later) is. July 2019) for the tax period beginning on july 1, 2019, and ending on june 30, 2020. You can visit the official irs website to download and print out the blank 2290 form for 2022. Download and print the heavy highway vehicle use tax return for the period july 1, 2023, through june 30, 2024. The sample is available in. Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Download and print the heavy highway vehicle use tax return for the period july 1, 2023, through june 30, 2024. Don’t use this revision if you need to file a return for a tax period that. Download form 2290. Form 2290 is used to figure and. You must file this form 2290 (rev. The form 2290 will allow the filer to calculate and pay any taxes due on highway motor vehicles with a gross weight of 55,000 pounds or more. The sample is available in pdf format; Get schedule 1 in minutes. Known as the heavy highway vehicle use tax return, this form. Download form 2290 for current and previous years. Filing online is simple, fast & secure. The sample is available in pdf format; You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway. July 2019) for the tax period beginning on july 1, 2019, and ending on june 30, 2020. Browse 11 form 2290 templates collected for any of your needs. You must file this form 2290 (rev. Once you’ve chosen a payment method and reviewed your form 2290 for accuracy, it’s time to submit your return. Our guide ensures you meet irs. The sample is available in pdf format; Browse 11 form 2290 templates collected for any of your needs. You can visit the official irs website to download and print out the blank 2290 form for 2022. You must file this form 2290 (rev. Like all tax forms, this form requires personal. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021. The current period begins july 1, 2024, and ends june 30,. Our guide ensures you meet irs requirements and stay compliant with truck tax regulations. You'll need a pdf reader to open. You can visit the official irs website to download and print out the blank 2290 form for 2022. The current period begins july 1, 2024, and ends june 30,. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021. Form 2290 is. Browse 11 form 2290 templates collected for any of your needs. You must file this form 2290 (rev. Access printable form 2290 for easy completion and filing. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021. Once you’ve chosen a payment method and reviewed your form 2290 for accuracy, it’s time to submit your return. Download and print the heavy highway vehicle use tax return for the period july 1, 2023, through june 30, 2024. Form 2290 is used to figure and. The form 2290 will allow the filer to calculate and pay any taxes due on highway motor vehicles with a gross weight of 55,000 pounds or more. Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. The current period begins july 1, 2024, and ends june 30,. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway motor vehicle (defined later) is registered, or Filing online is simple, fast & secure. Follow the instructions and attach both copies of schedule 1 to this form. This irs form 2290 is used for reporting heavy highway vehicle use tax. Our guide ensures you meet irs requirements and stay compliant with truck tax regulations. It covers the tax period from july 1, 2020, to june 30, 2021.2290 Form 2021 Printable Printable Word Searches

Irs Form 2290 Printable 2024

Irs Form 2290 Printable

Irs Form 2290 Printable 2024

Irs Form 2290 Printable 2024

Irs Form 2290 Printable 2023 To 2024

Printable Irs Form 2290 2020 2021

Irs Form 2290 Printable 2022 Pdf Download

Irs Form 2290 Printable 2025

Irs Form 2290 Printable

The Sample Is Available In Pdf Format;

Don’t Use This Revision If You Need To File A Return For A Tax Period That.

Get Schedule 1 In Minutes.

Like All Tax Forms, This Form Requires Personal.

Related Post: