Free Printable Tax Deduction Worksheet

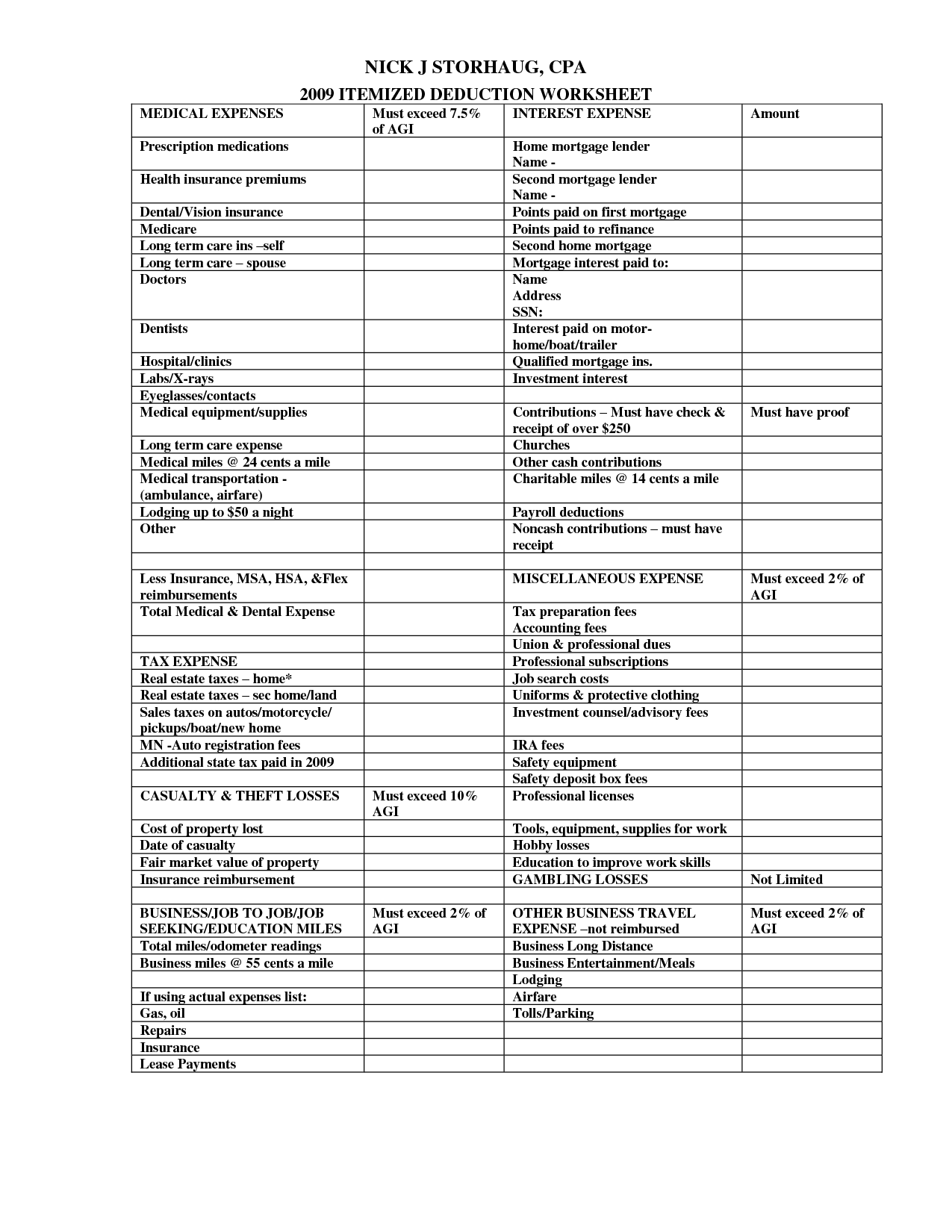

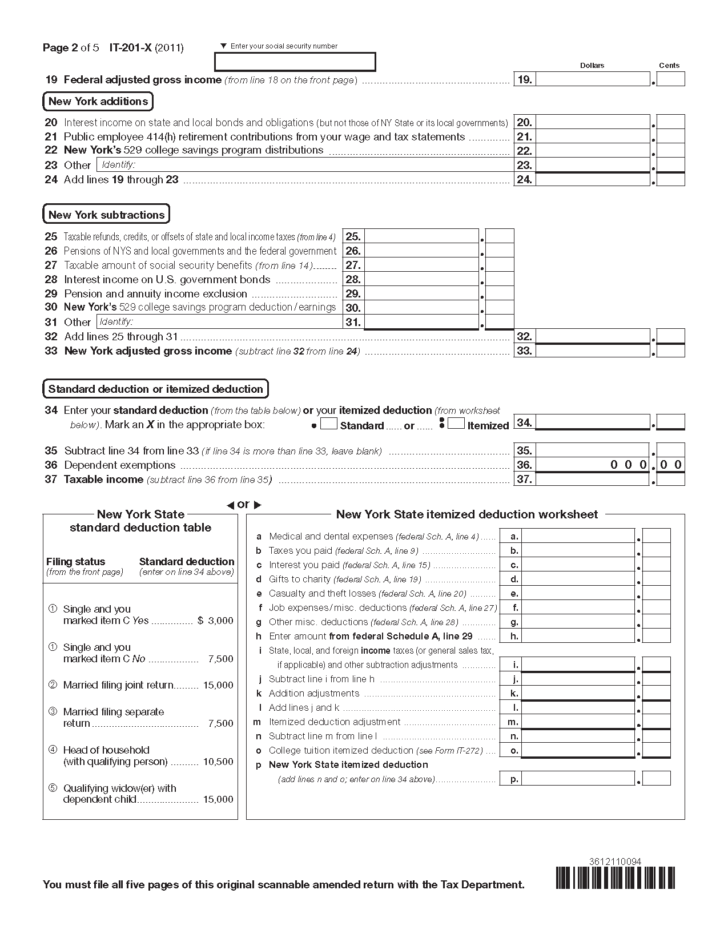

Free Printable Tax Deduction Worksheet - Benji's free business expense tracking. Irs free file lets qualified taxpayers get free tax preparation, free electronic filing and free direct deposit of their federal tax refund, if they’re owed one,. Best 5 free tax expense spreadsheets. This pdf form is used to determine the correct federal income tax withholding from your pay. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550 if married): It includes steps to enter personal information, multiple jobs, dependent and other credits, and. Choose from general, occupation, specialized and home improvement topics. Prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel templates. Medical and dental expenses are deductible only to the extent they exceed 7.5% of your adjusted gross income for tax year 2024 and are. The tax deduction template is specially designed to provide you with an easier solution to your yearly deduction’s calculator. Best 5 free tax expense spreadsheets. The tax deduction template is specially designed to provide you with an easier solution to your yearly deduction’s calculator. Tax information documents (receipts, statements, invoices, vouchers) for your own records. Benji's free business expense tracking. This pdf form is used to determine the correct federal income tax withholding from your pay. Itemized deductions worksheet you will need: Choose from general, occupation, specialized and home improvement topics. These templates include simple tax. That's why we created this free home office deduction worksheet. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married): Irs free file lets qualified taxpayers get free tax preparation, free electronic filing and free direct deposit of their federal tax refund, if they’re owed one,. Download this income tax worksheet aka income tax organizer to maximize your deductions and minimize errors and omissions. This pdf form is used to determine the correct federal income tax withholding from your pay.. Tax information documents (receipts, statements, invoices, vouchers) for your own records. Itemized deductions worksheet you will need: It provides a comprehensive breakdown of common deductions related to. Please print your name safe deposit box $ subscriptions (trade journals) $ tax preparation fee $ please sign your name date schedule a tax deduction worksheet medical. Site offers free information to help. Download pdf forms and worksheets to organize your data for income tax preparation. Site offers free information to help you plan and. Download this income tax worksheet aka income tax organizer to maximize your deductions and minimize errors and omissions. This tax organizer is designed to help you collect and report the information needed to prepare your 2023 income tax. That's why we created this free home office deduction worksheet. Medical and dental expenses are deductible only to the extent they exceed 7.5% of your adjusted gross income for tax year 2024 and are. It includes steps to enter personal information, multiple jobs, dependent and other credits, and. This tax deduction worksheet is designed to help individuals itemize their tax. This tax organizer is designed to help you collect and report the information needed to prepare your 2023 income tax return. This tax deduction worksheet is designed to help individuals itemize their tax deductions for the year effectively. Choose from general, occupation, specialized and home improvement topics. Medical and dental expenses are deductible only to the extent they exceed 7.5%. Best 5 free tax expense spreadsheets. 2 net investment income tax. Tax information documents (receipts, statements, invoices, vouchers) for your own records. It includes steps to enter personal information, multiple jobs, dependent and other credits, and. This pdf form is used to determine the correct federal income tax withholding from your pay. It provides a comprehensive breakdown of common deductions related to. Please print your name safe deposit box $ subscriptions (trade journals) $ tax preparation fee $ please sign your name date schedule a tax deduction worksheet medical. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550 if. Tax information documents (receipts, statements, invoices, vouchers) for your own records. 2 net investment income tax. This tax organizer is designed to help you collect and report the information needed to prepare your 2023 income tax return. It provides a comprehensive breakdown of common deductions related to. It includes steps to enter personal information, multiple jobs, dependent and other credits,. This pdf form is used to determine the correct federal income tax withholding from your pay. Enter the first description, the amount, and. Otherwise, reporting total figures on this form. Choose from general, occupation, specialized and home improvement topics. Download this income tax worksheet aka income tax organizer to maximize your deductions and minimize errors and omissions. 2 net investment income tax. Benji's free business expense tracking. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550 if married): Choose from general, occupation, specialized and home improvement topics. That's why we created this free home office deduction worksheet. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550 if married): The tax deduction template is specially designed to provide you with an easier solution to your yearly deduction’s calculator. Download pdf forms and worksheets to organize your data for income tax preparation. That's why we created this free home office deduction worksheet. Tax information documents (receipts, statements, invoices, vouchers) for your own records. Please print your name safe deposit box $ subscriptions (trade journals) $ tax preparation fee $ please sign your name date schedule a tax deduction worksheet medical. Itemized deductions worksheet you will need: Benji's free business expense tracking. It provides a comprehensive breakdown of common deductions related to. This pdf form is used to determine the correct federal income tax withholding from your pay. These templates include simple tax. It includes steps to enter personal information, multiple jobs, dependent and other credits, and. Just hit make a copy,” and you'll be able to track all your home office expenses in one place. Choose from general, occupation, specialized and home improvement topics. 2 net investment income tax. Otherwise, reporting total figures on this form.Itemized Tax Deduction Template

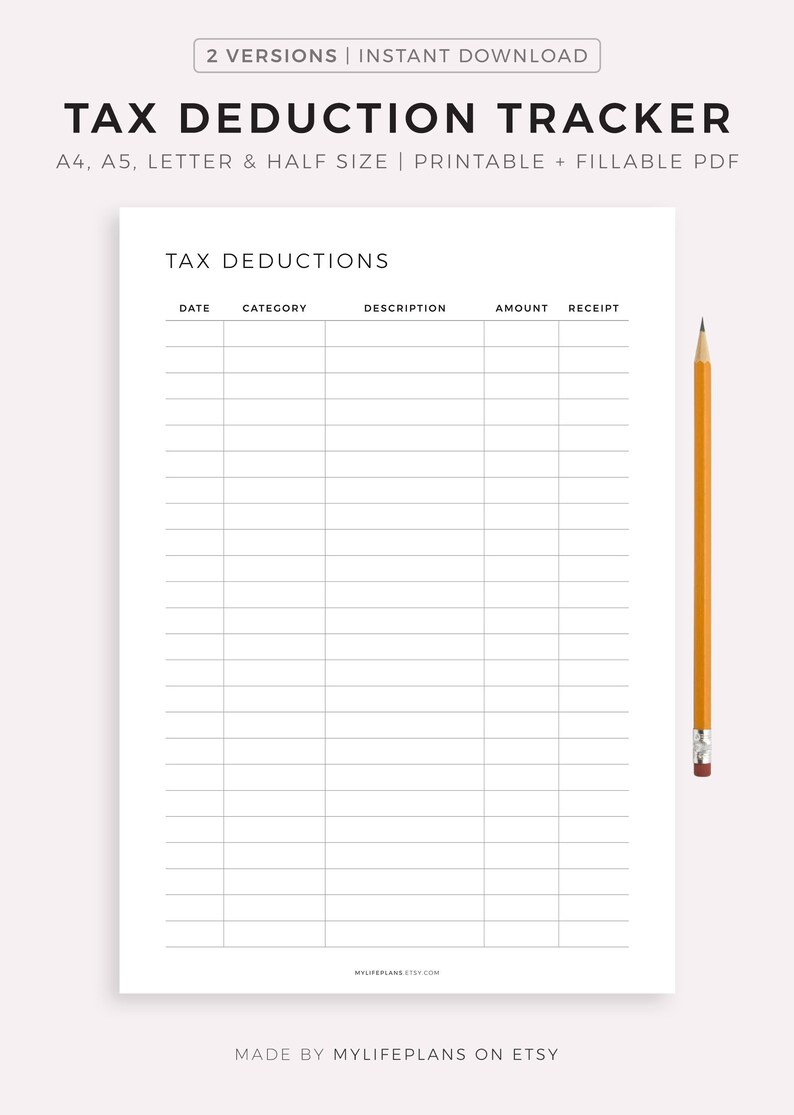

Tax Deduction Tracker Printable A4/a5/letter/half Instant Etsy

Printable Itemized Deductions Worksheet

Printable Real Estate Agent Tax Deductions Worksheet

Simplify Your Tax Deductions with Printable Sheets Wiki Printable

Free Tax Deduction Worksheet

How to organize your taxes with a printable tax planner All About

Deductions Worksheet For Taxes

Printable Itemized Deductions Worksheet

Self Employment Printable Small Business Tax Deductions Work

Irs Free File Lets Qualified Taxpayers Get Free Tax Preparation, Free Electronic Filing And Free Direct Deposit Of Their Federal Tax Refund, If They’re Owed One,.

Site Offers Free Information To Help You Plan And.

Medical And Dental Expenses Are Deductible Only To The Extent They Exceed 7.5% Of Your Adjusted Gross Income For Tax Year 2024 And Are.

Keeper Tax Office Deduction Template;

Related Post: