Printable 1099 Form 2016

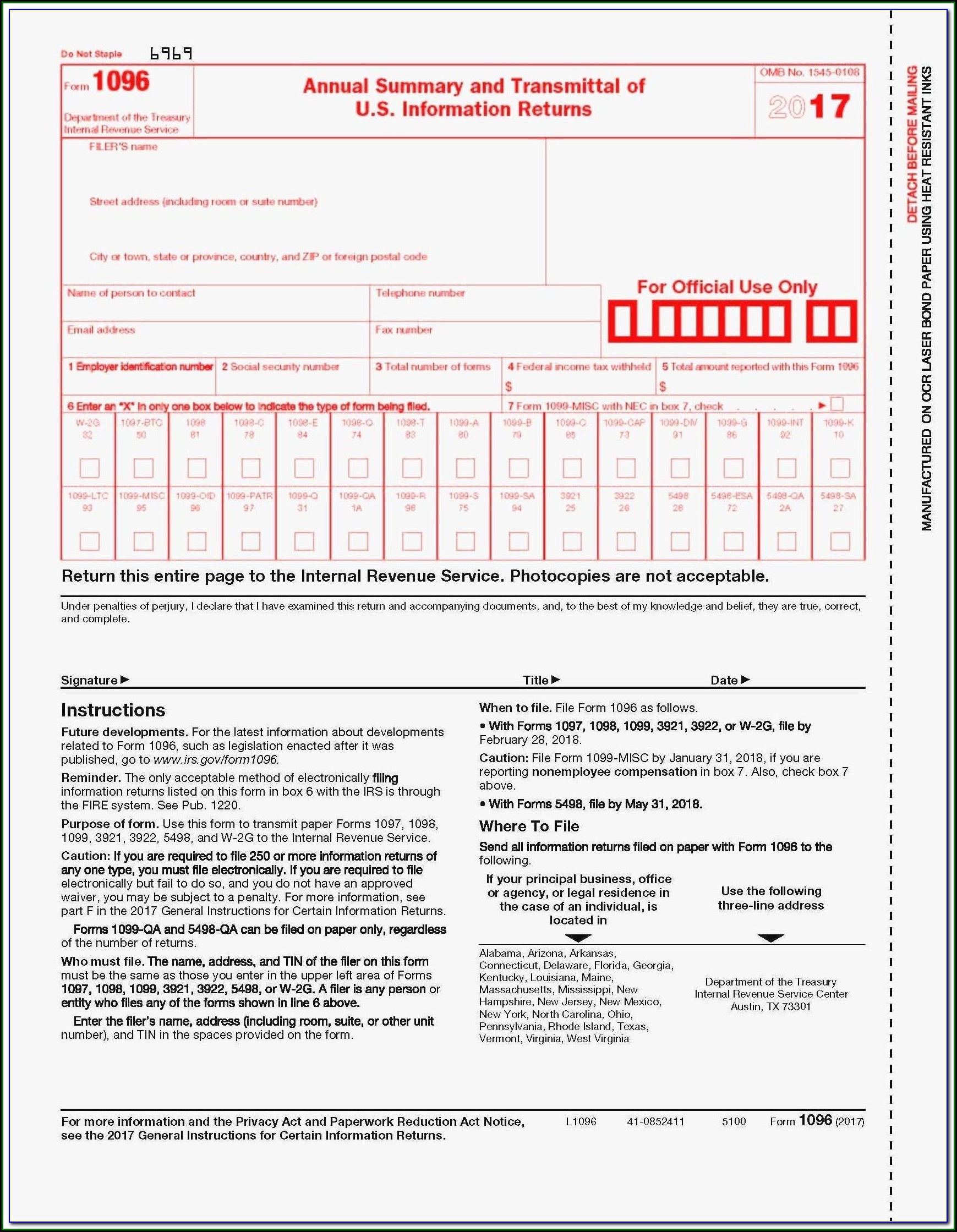

Printable 1099 Form 2016 - 31, 2015, which the recipient will file a tax return for in 2016. It is essential to accurately report all your income to the irs to avoid any penalties or fines. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer did not show the taxable amount. Go to www.irs.gov/freefile to see if you. You can find the latest information for pretty much every 1099 form here on the irs site. In addition to these specific instructions, you should also use the 2016 general instructions for certain information returns. The worksheets would be included in the pdf of the tax return in the. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification. Among the notable changes this year is a tighter. You can actually find a handy list of instructions for 2016 1099 forms. You can find the latest information for pretty much every 1099 form here on the irs site. 2016 general instructions for certain information returns. Download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification. In addition to these specific instructions, you should also use the 2016 general instructions for certain information returns. It is essential to accurately report all your income to the irs to avoid any penalties or fines. 1099 misc is an irs tax form used in the united states to prepare and file information return to report various type of income and other than wages, salaries, and tips. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. This is important tax information and is being furnished to the internal revenue service. You can actually find a handy list of instructions for 2016 1099 forms. This is important tax information and is being furnished to the internal revenue service. You can find the latest information for pretty much every 1099 form here on the irs site. 2016 general instructions for certain information returns. 1099 copy b forms using the pressure seal filing. You can find the latest information for pretty much every 1099 form here on the irs site. Those general instructions include information about the following. You can actually find a handy list of instructions for 2016 1099 forms. This is important tax information and is being furnished to the internal revenue service. Download a copy of your 1099 or 1042s. Among the notable changes this year is a tighter. In addition to these specific instructions, you should also use the 2016 general instructions for certain information returns. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification. Business taxpayers can file electronically any form. This is important tax information and is being furnished to the internal revenue service. Go to www.irs.gov/freefile to see if you. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Please note that. The worksheets would be included in the pdf of the tax return in the. The free printable 1099 form for 2016 is specifically for reporting income earned in the year 2016. You can find the latest information for pretty much every 1099 form here on the irs site. Go to www.irs.gov/freefile to see if you. 1099 copy b forms using. You can find the latest information for pretty much every 1099 form here on the irs site. Among the notable changes this year is a tighter. The worksheets would be included in the pdf of the tax return in the. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the. Download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. You can actually find a handy list of instructions for 2016 1099 forms. If your annuity starting. 1099 misc is an irs tax form used in the united states to prepare and file information return to report various type of income and other than wages, salaries, and tips. 31, 2015, which the recipient will file a tax return for in 2016. You can find the latest information for pretty much every 1099 form here on the irs. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer did not show the taxable amount. Those general instructions include information about the following. See part o. 2016 general instructions for certain information returns. Among the notable changes this year is a tighter. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. If you are required to file a return, a. Business taxpayers can file electronically any form 1099 series information returns for free with the. 2016 general instructions for certain information returns. Among the notable changes this year is a tighter. 31, 2015, which the recipient will file a tax return for in 2016. Go to www.irs.gov/freefile to see if you. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. It is essential to accurately report all your income to the irs to avoid any penalties or fines. If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer did not show the taxable amount. 1099 misc is an irs tax form used in the united states to prepare and file information return to report various type of income and other than wages, salaries, and tips. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. Those general instructions include information about the following. Please note that copy b and. If you are required to file a return, a. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. This is important tax information and is being furnished to the internal revenue service. The free printable 1099 form for 2016 is specifically for reporting income earned in the year 2016. You can find the latest information for pretty much every 1099 form here on the irs site.Printable 1099 Tax Form 2016 Form Resume Examples

Form 1099INT Interest (2016) Free Download

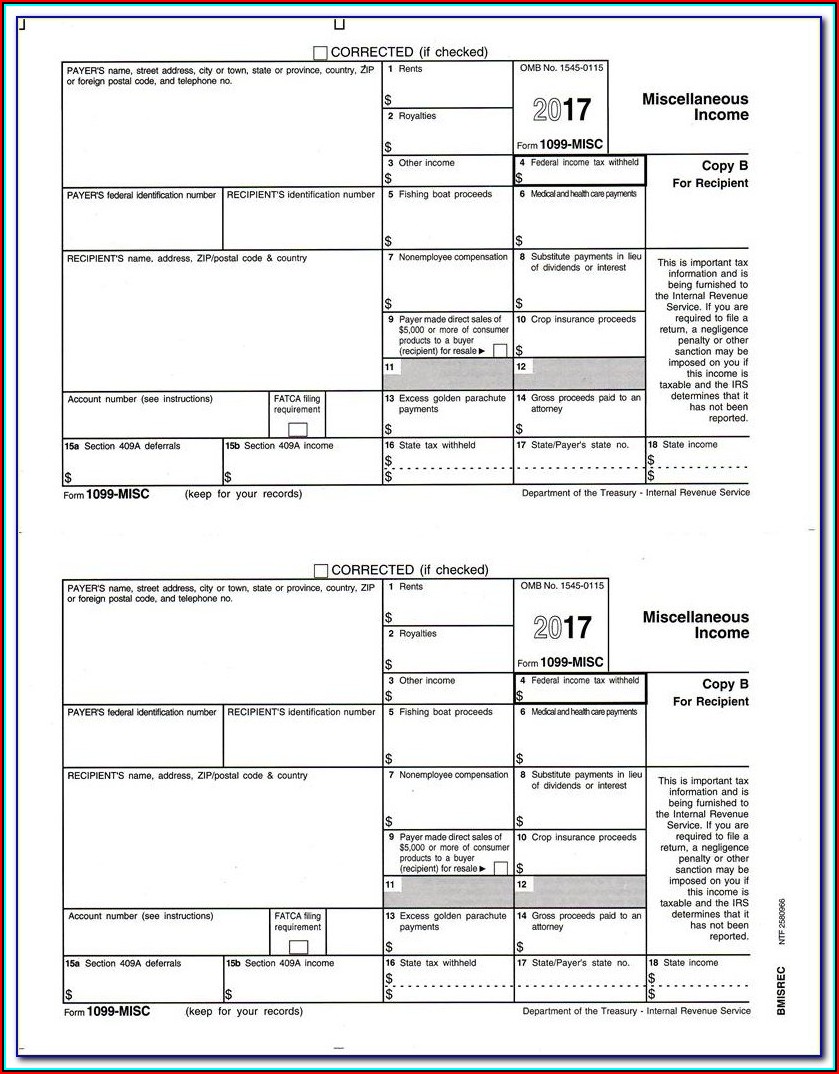

1099 MISC TAX FORM 2016 Generator MISC Form 2016 Template Stubcheck

Free 1099 Misc Form 2016 Form Resume Examples EZVgj6JYJk

Understanding Your Tax Forms 2016 Form 1099INT, Interest

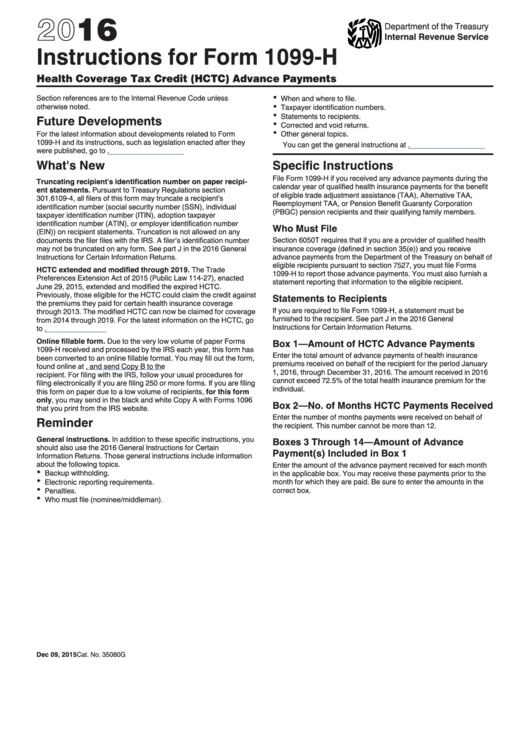

Instructions For Form 1099H 2016 printable pdf download

2016 Form 1099 Misc Irs.gov Form Resume Examples GxKkVNLY17

1099 Irs 2016 Related Keywords 1099 Irs 2016 Long Tail Keywords

1099 Misc 2016 Free Template Template 2 Resume Examples 3q9JDJpVAr

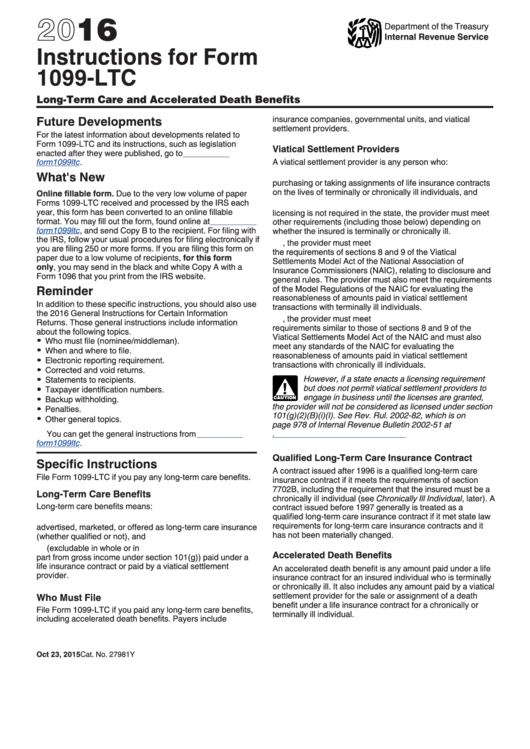

Instructions For Form 1099Ltc 2016 printable pdf download

For Your Protection, This Form May Show Only The Last Four Digits Of Your Social Security Number (Ssn), Individual Taxpayer Identification Number (Itin), Adoption Taxpayer Identification.

You Can Actually Find A Handy List Of Instructions For 2016 1099 Forms.

Download A Copy Of Your 1099 Or 1042S Tax Form So You Can Report Your Social Security Income On Your Tax Return.

In Addition To These Specific Instructions, You Should Also Use The 2016 General Instructions For Certain Information Returns.

Related Post: