Printable 609 Letter Template

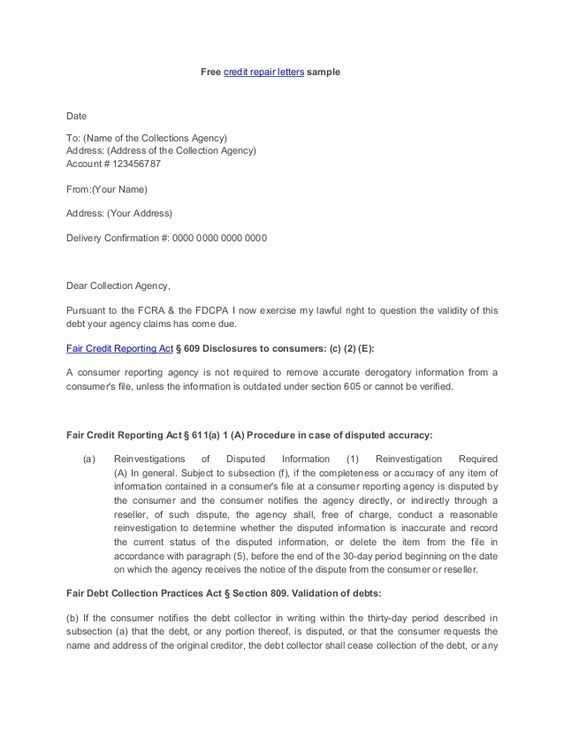

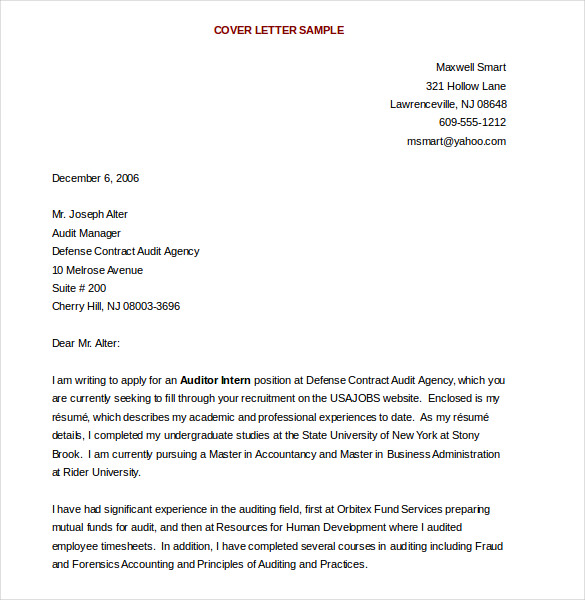

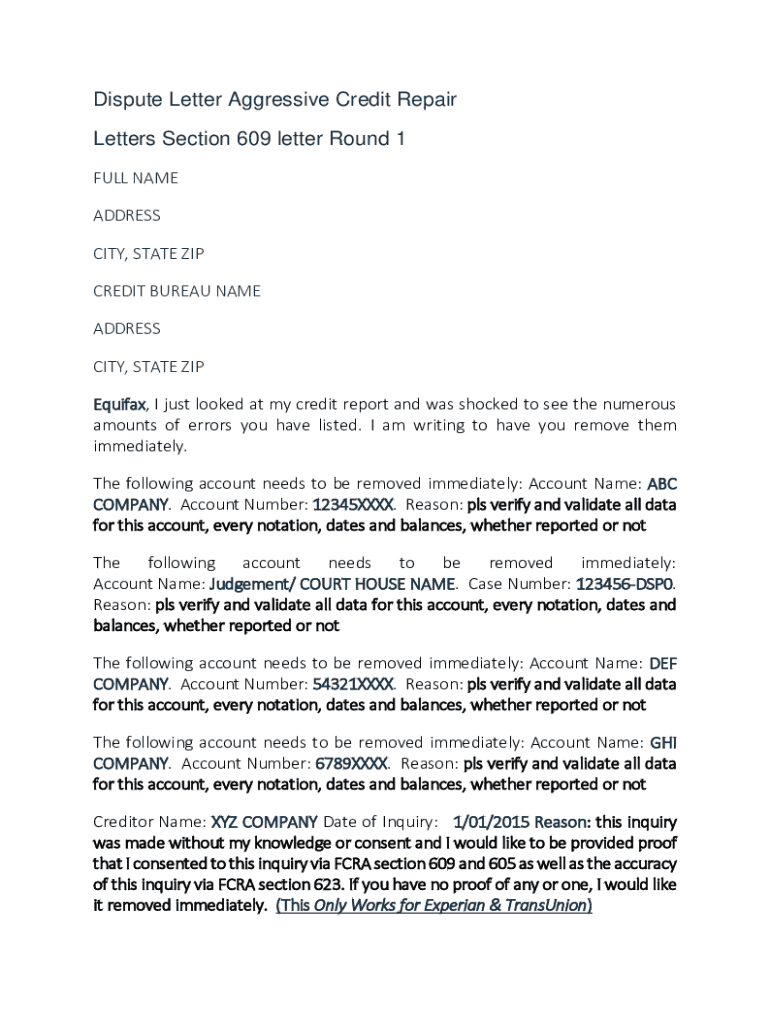

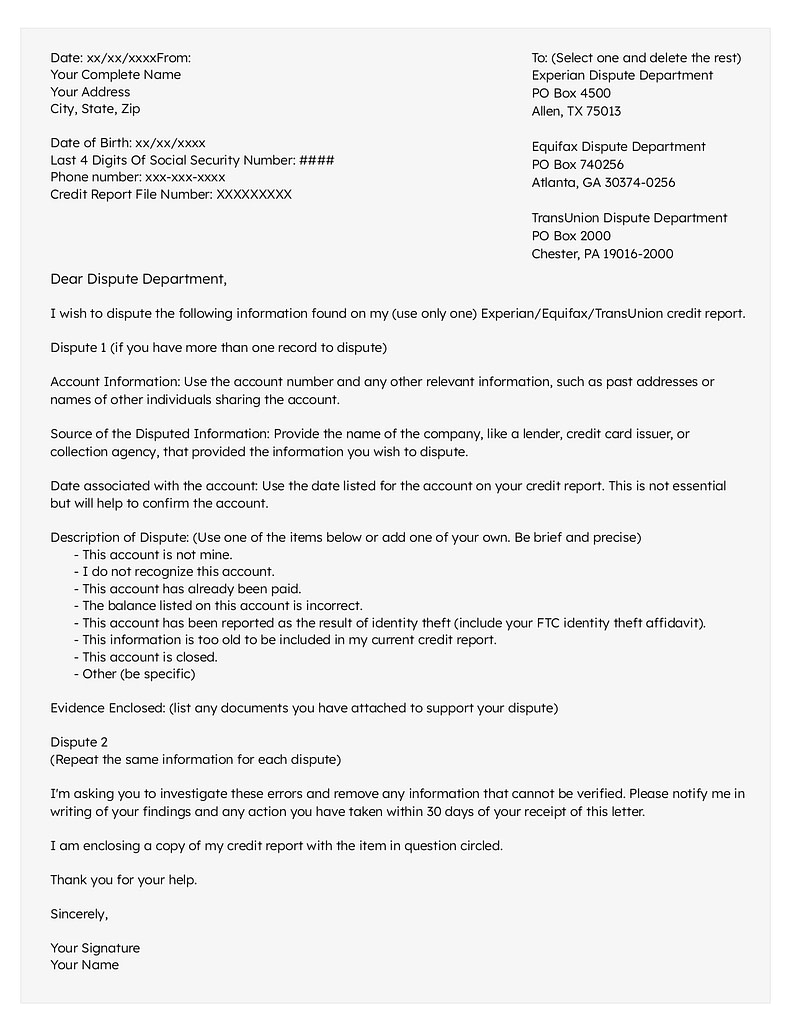

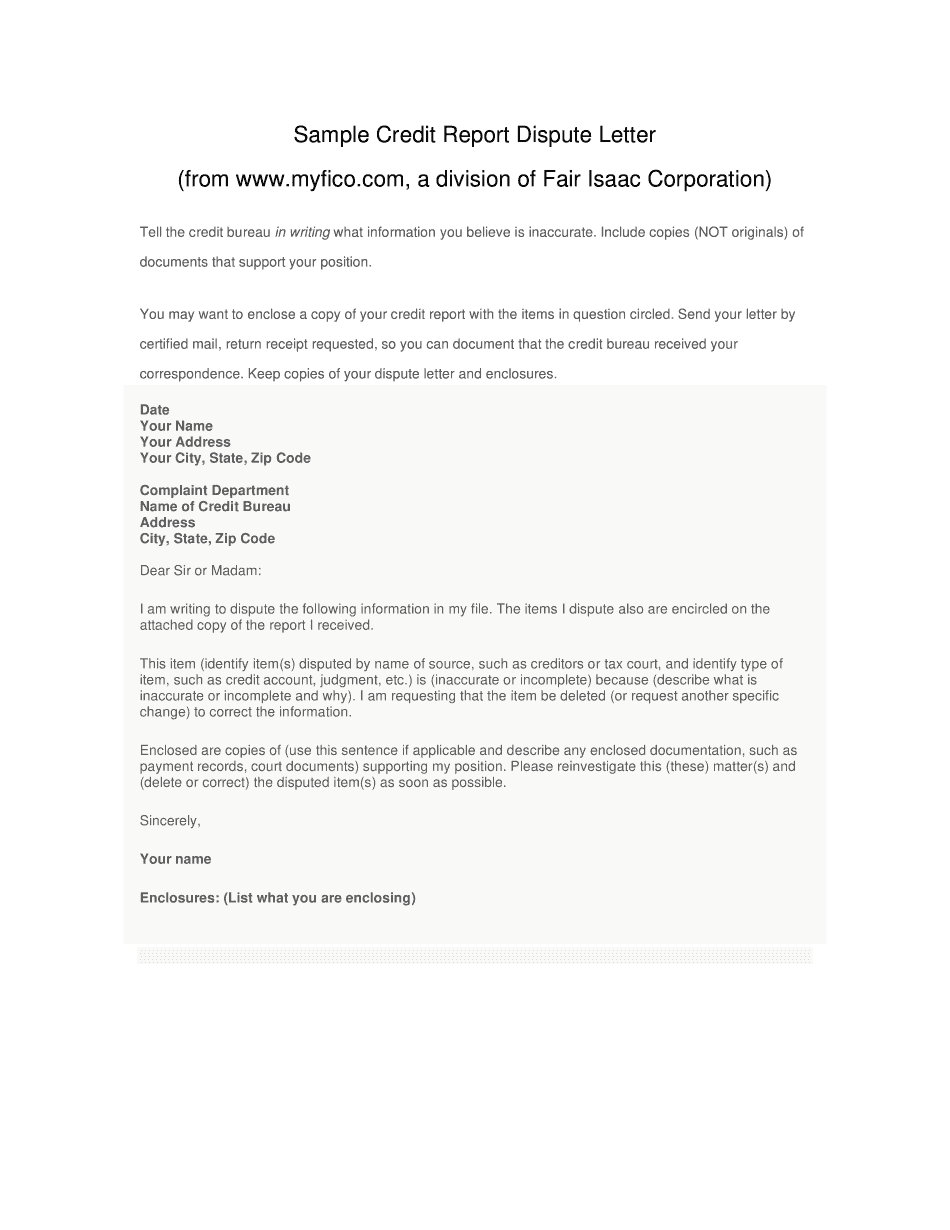

Printable 609 Letter Template - In this article, we’ll explain how these letters work, what to include, and how they can support your credit repair efforts. Provide the name of the company, like a lender, credit card issuer, or collection agency, that provided the information you wish to dispute. Type text, add images, blackout. Section 609 outlines your right to receive copies of. You can also download it, export it or print it out. Source of the disputed information: No need to install software, just go to dochub, and sign up instantly and for free. Up to 40% cash back edit, sign, and share 609 letter template online. Edit your 609 letter online. Per section 609, i am entitled to. Edit your 609 letter online. Up to 40% cash back send 609 letter template via email, link, or fax. Section 609 outlines your right to receive copies of. I am exercising my right under the fair credit reporting act, section 609, to request information regarding an item that is listed on my consumer credit report. Source of the disputed information: Per section 609, i am entitled to. A 609 dispute letter cites the fair credit reporting act, section 609 as basis for disputing and requesting removal of incorrect or unverifiable information on your credit report. The fcra is the primary federal law outlining credit. Provide the name of the company, like a lender, credit card issuer, or collection agency, that provided the information you wish to dispute. A 609 letter, also known as a 609 dispute letter, can help you remove “unverifiable” bad marks, boost your credit score, and help you qualify for loans that you otherwise wouldn’t. Most people who are looking for a 609 dispute letter template already have an idea of what it is, but for those who don’t, or those who want to learn about how the letter works,. Edit your 609 letter online. Consumers who find errors on their credit reports legally have the right under the fair credit reporting act (fcra) to. Provide the name of the company, like a lender, credit card issuer, or collection agency, that provided the information you wish to dispute. A 609 letter is a formal written request sent to credit bureaus, invoking rights under section 609 of the fcra. Section 609 outlines your right to receive copies of. You can also download it, export it or. Fortunately, you can challenge inaccurate items with a 609 dispute letter. Most people who are looking for a 609 dispute letter template already have an idea of what it is, but for those who don’t, or those who want to learn about how the letter works,. A 609 letter is a formal written request sent to credit bureaus, invoking rights. Section 609 outlines your right to receive copies of. Section 609 of the fair credit reporting act has legal specifications that can save you a lot of trouble from getting tagged as a credit risk. Up to 40% cash back edit, sign, and share 609 letter template online. Source of the disputed information: I am exercising my right under the. Up to 40% cash back send 609 letter template via email, link, or fax. In this article, we’ll explain how these letters work, what to include, and how they can support your credit repair efforts. Most people who are looking for a 609 dispute letter template already have an idea of what it is, but for those who don’t, or. Per section 609, i am entitled to. You can also download it, export it or print it out. Provide the name of the company, like a lender, credit card issuer, or collection agency, that provided the information you wish to dispute. Most people who are looking for a 609 dispute letter template already have an idea of what it is,. Most people who are looking for a 609 dispute letter template already have an idea of what it is, but for those who don’t, or those who want to learn about how the letter works,. Per section 609, i am entitled to. I am exercising my right under the fair credit reporting act, section 609, to request information regarding an. Up to 40% cash back edit, sign, and share 609 letter template online. Most people who are looking for a 609 dispute letter template already have an idea of what it is, but for those who don’t, or those who want to learn about how the letter works,. Section 609 outlines your right to receive copies of. Edit your 609. Consumers who find errors on their credit reports legally have the right under the fair credit reporting act (fcra) to view their information and dispute any blemishes found. Edit your 609 letter online. A 609 letter, also known as a 609 dispute letter, can help you remove “unverifiable” bad marks, boost your credit score, and help you qualify for loans. A 609 dispute letter is a letter to credit bureaus requesting to verify certain entries which are negative. A 609 letter, also known as a 609 dispute letter, can help you remove “unverifiable” bad marks, boost your credit score, and help you qualify for loans that you otherwise wouldn’t. Fortunately, you can challenge inaccurate items with a 609 dispute letter.. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from. In this article, we’ll explain how these letters work, what to include, and how they can support your credit repair efforts. A 609 letter is a formal written request sent to credit bureaus, invoking rights under section 609 of the fcra. I am exercising my right under the fair credit reporting act, section 609, to request information regarding an item that is listed on my consumer credit report. Per section 609, i am entitled to. Consumers who find errors on their credit reports legally have the right under the fair credit reporting act (fcra) to view their information and dispute any blemishes found. Am writing to inform you of an error on my credit report and request that you provide me with verifiable proof or delete the record immediately as afforded to me by the fair credit reporting. Section 609 outlines your right to receive copies of. You can also download it, export it or print it out. A 609 dispute letter is a letter to credit bureaus requesting to verify certain entries which are negative. Type text, add images, blackout. Up to 40% cash back edit, sign, and share 609 letter template online. A 609 dispute letter cites the fair credit reporting act, section 609 as basis for disputing and requesting removal of incorrect or unverifiable information on your credit report. Source of the disputed information: No need to install software, just go to dochub, and sign up instantly and for free. Provide the name of the company, like a lender, credit card issuer, or collection agency, that provided the information you wish to dispute.Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]

609 Letter Template Free Printable Templates

609 Letter Template Pdf Fill and Sign Printable Template Online US

Printable 609 Letter Template Fillable Form 2023

Example Of A 609 Credit Dispute Letter

Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]

609 Letter Template 20082024 Form Fill Out and Sign Printable PDF

609 Letter Template planner template free

Pdf Printable Free 609 Credit Dispute Letter Templates

Fillable Online 609 Letter Template Fill Online, Printable, Fillable

Up To 40% Cash Back Send 609 Letter Template Via Email, Link, Or Fax.

Fortunately, You Can Challenge Inaccurate Items With A 609 Dispute Letter.

Section 609 Of The Fair Credit Reporting Act Has Legal Specifications That Can Save You A Lot Of Trouble From Getting Tagged As A Credit Risk.

The Fcra Is The Primary Federal Law Outlining Credit.

Related Post:

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/letter-to-dispute-credit-report.jpg?gid=126)

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/credit-dispute-letter-pdf.jpg?gid=126)