Printable Schedule C Form

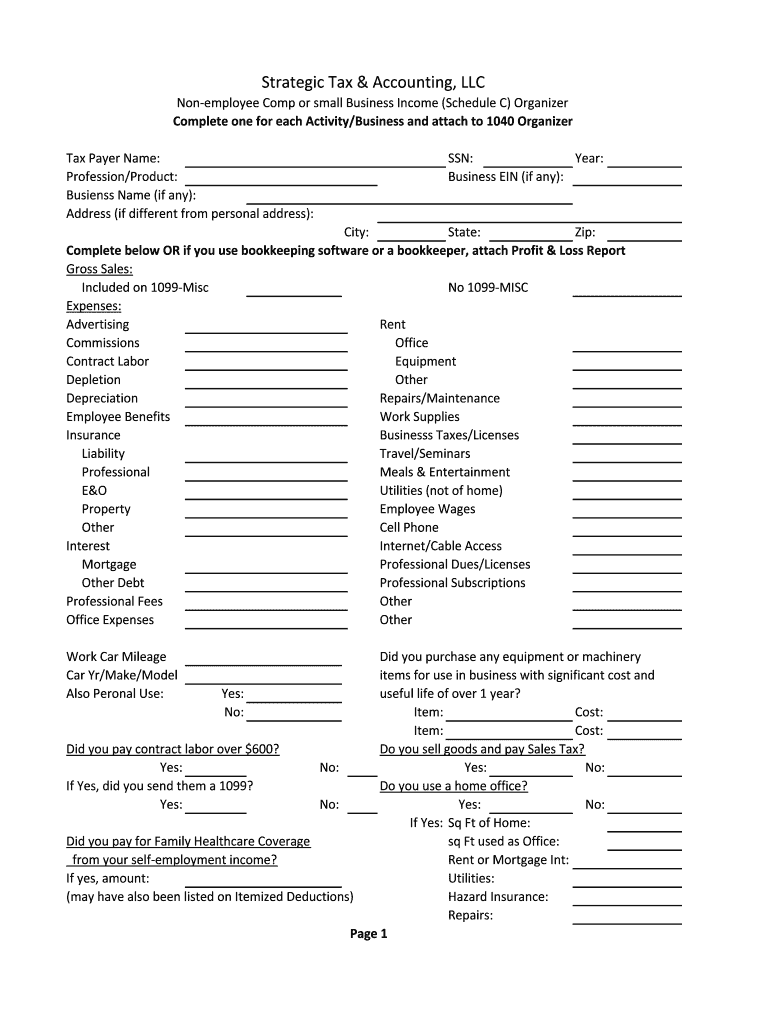

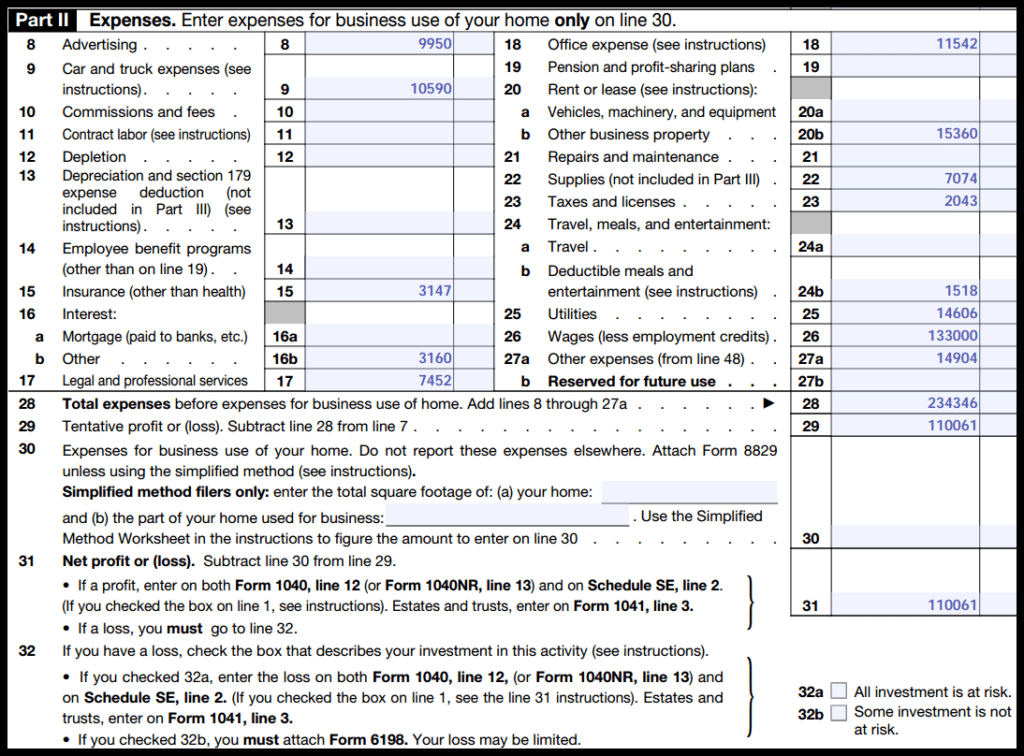

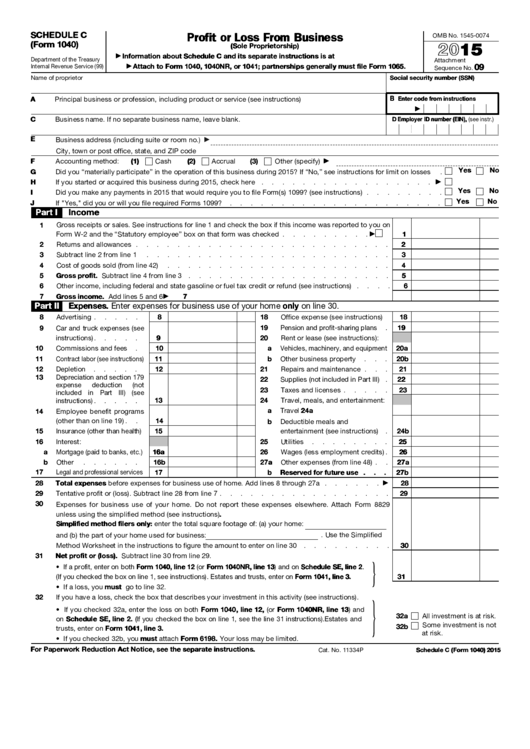

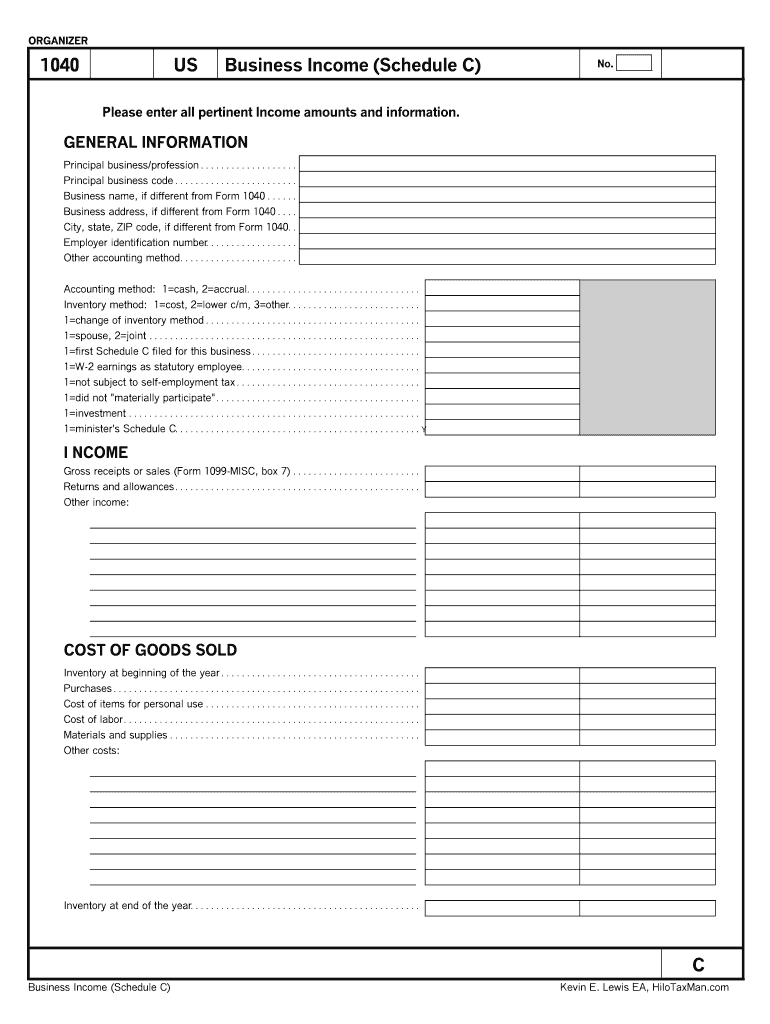

Printable Schedule C Form - Browse 21 form 1040 schedule c templates collected for any of your needs. Are the qualified energy efficiency improvements installed in or on your main home located in the united states? View, download and print fillable schedule c irs 1040 in pdf format online. Schedule c form 1040 profit or loss business. Accurate completion of this schedule ensures that business income and expenses. Download or print the 2024 federal schedule c instructions (schedule c instructions) for free from the federal internal revenue service. The form is a part of the individual tax return, so the net income or loss gets. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal internal revenue service. It provides comprehensive guidelines to help. This file is essential for sole proprietors to report income and expenses from their business. Browse 21 form 1040 schedule c templates collected for any of your needs. Accurate completion of this schedule ensures that business income and expenses. It provides comprehensive guidelines to help. Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker, freelancer, small business owner, or. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal internal revenue service. An activity qualifies as a business if your primary. 32b for paperwork reduction act notice, see the separate instructions. Download or print the 2024 federal schedule c instructions (schedule c instructions) for free from the federal internal revenue service. If you are the sole owner of a business or operate as an independent contractor, you will need to file a schedule c to report income or loss from your business activities. Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker, freelancer, small business owner, or. This file is essential for sole proprietors to report income and expenses from their business. An activity qualifies as a business if your primary. You should file a schedule c if the primary. Schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and. You should file a schedule c if the primary purpose of your business is to. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor.. If you are the sole owner of a business or operate as an independent contractor, you will need to file a schedule c to report income or loss from your business activities. An activity qualifies as a business if your primary. Schedule c form 1040 profit or loss business. Are the qualified energy efficiency improvements installed in or on your. Accurate completion of this schedule ensures that business income and expenses. Schedule c form 1040 profit or loss business. Schedule c (form 1040) is essential for reporting business income and expenses to calculate net profit or loss. Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker, freelancer,. It provides comprehensive guidelines to help. Download or print the 2024 federal schedule c instructions (schedule c instructions) for free from the federal internal revenue service. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; An activity qualifies as a business. 32b for paperwork reduction act notice, see the separate instructions. Are the qualified energy efficiency improvements installed in or on your main home located in the united states? You should file a schedule c if the primary purpose of your business is to. Profit or loss from business reports how much money you made or lost in a business you. Schedule c form 1040 profit or loss business. Schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and. Accurate completion of this schedule ensures that business income and expenses. 32b for paperwork reduction act notice, see the separate instructions. Printable federal income tax schedule c. This file is essential for sole proprietors to report income and expenses from their business. An activity qualifies as a business if your primary. 32b for paperwork reduction act notice, see the separate instructions. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. The form is a part of. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal internal revenue service. Browse 21 form 1040 schedule c templates collected for any of your needs. Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker,. Browse 21 form 1040 schedule c templates collected for any of your needs. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Profit or loss. Browse 21 form 1040 schedule c templates collected for any of your needs. This file is essential for sole proprietors to report income and expenses from their business. Are the qualified energy efficiency improvements installed in or on your main home located in the united states? Schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and. View, download and print fillable schedule c irs 1040 in pdf format online. Profit or loss from business reports how much money you made or lost in a business you operated as a gig worker, freelancer, small business owner, or. The form is a part of the individual tax return, so the net income or loss gets. If you are the sole owner of a business or operate as an independent contractor, you will need to file a schedule c to report income or loss from your business activities. 32b for paperwork reduction act notice, see the separate instructions. It provides comprehensive guidelines to help. Schedule c (form 1040) is essential for reporting business income and expenses to calculate net profit or loss. Accurate completion of this schedule ensures that business income and expenses. Schedule c form 1040 profit or loss business. You should file a schedule c if the primary purpose of your business is to. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal internal revenue service. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;Fillable Online 2019 Schedule C (Form 1040 or 1040SR) Internal

IRS Schedule C Instructions StepbyStep (Including CEZ)

Fillable Schedule C Irs Form 1040 printable pdf download

IRS Form 1040 Schedule C (2021) Profit or Loss From Business

Schedule C Business Codes Fill and Sign Printable Template Online

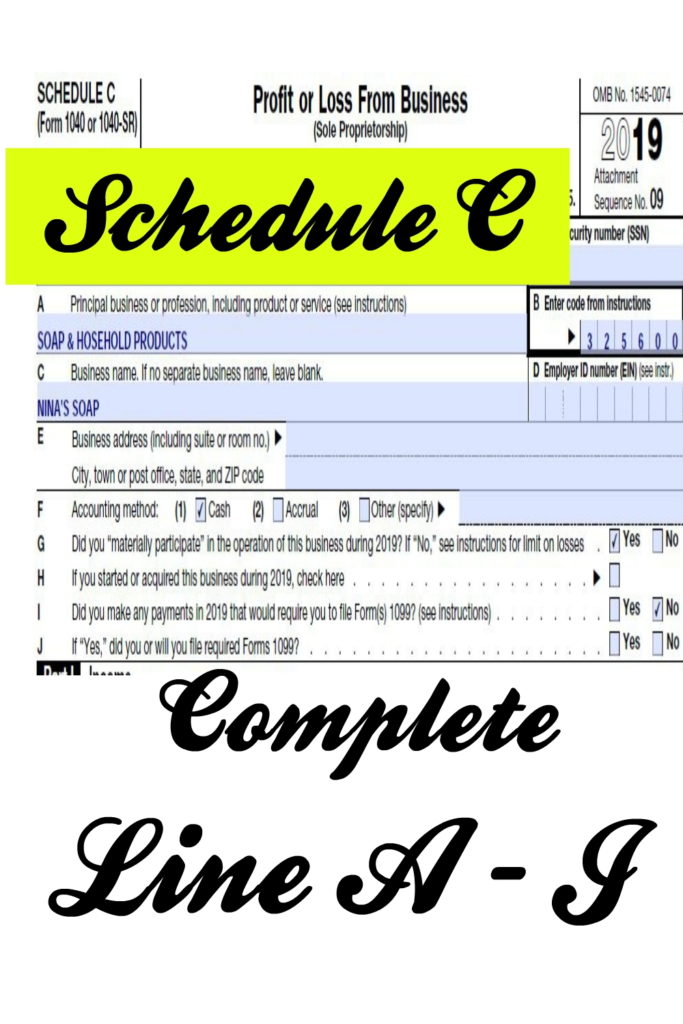

How to Complete 2019 Schedule C Form 1040 Line A to J Nina's Soap

Printable 1040 Schedule C

Schedule C (Form 1040) Expense Cost Of Goods Sold

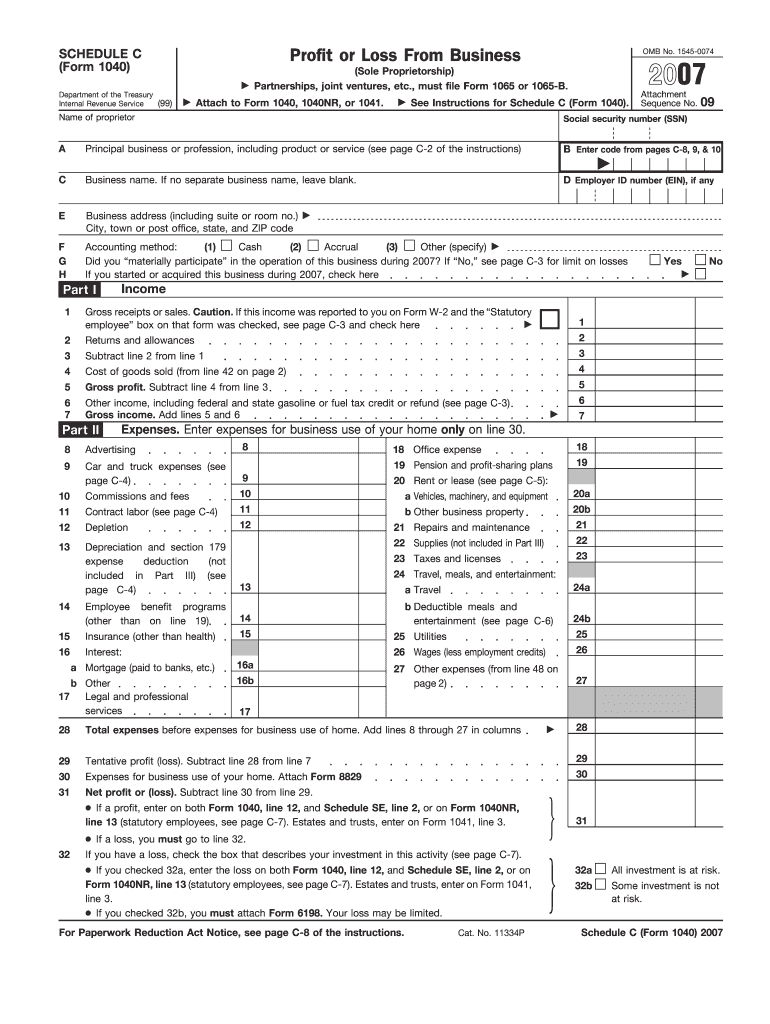

2007 Form IRS 1040 Schedule C Fill Online, Printable, Fillable, Blank

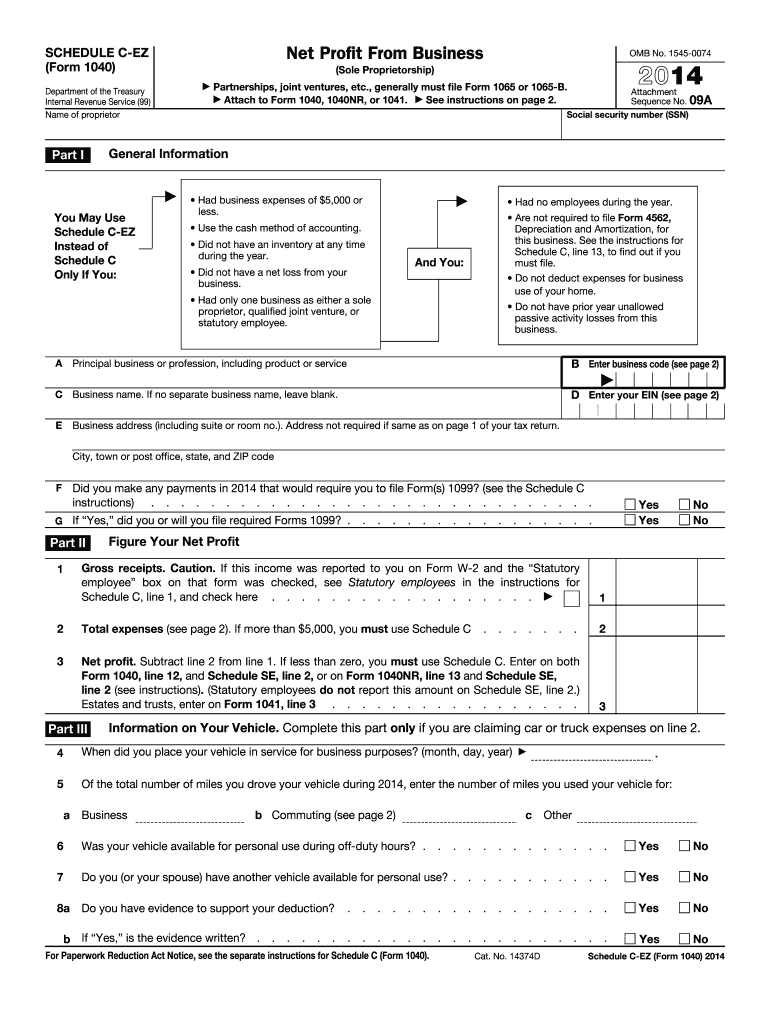

2014 Form IRS 1040 Schedule CEZ Fill Online, Printable, Fillable

Printable Federal Income Tax Schedule C.

Sectioned Into Parts, It Includes Detailed.

Use Schedule C (Form 1040) To Report Income Or (Loss) From A Business You Operated Or A Profession You Practiced As A Sole Proprietor.

An Activity Qualifies As A Business If Your Primary.

Related Post: